Without a single word, lithium carbonate began to rise again, and there was a big increase in the end.

Gaogong Lithium Power Grid was informed that the current market price of battery-grade lithium carbonate has reached 165,000 yuan / month, more than 16% increase over the past 3 months, individual lithium carbonate enterprises even offer 170,000 yuan / ton is still in short supply, the downstream cathode material company said There is tremendous pressure on the purchase of lithium carbonate.

"Our current quotation is 170,000 yuan / ton, there is no inventory, customers need to pay for pre-paid and cash purchases to buy lithium carbonate, but can not get all the goods at once, we also owe customers some of the goods." A carbonated The sales person in charge of the lithium production company indicated to Ligong Lithium Power Grid that the current supply of lithium carbonate is relatively tight and the downstream demand is strong. The customers have the panic mentality of snapping up, but it is certain that lithium carbonate prices will continue to rise until the end of the year.

Lithium carbonate prices do not go back

In fact, the price of lithium carbonate has a long history, and since the market demand in April and May this year has driven and experienced a wave of price increases, it has maintained a high price. Due to the overall recovery of the new energy automotive market in the second half of the year and environmental protection audits, Lithium Carbonate once again entered a price increase channel and has become increasingly intensified.

"At present, 165,000 yuan / ton has been very difficult to get the goods, lithium carbonate manufacturers continue to increase prices and require cash purchases, but the cathode material companies are currently difficult to return funds, so the pressure on raw material procurement is particularly large." Li Jigang, deputy general manager of Lanzhou Energy Technology Co., Ltd., told Gaogong Lithium Power Grid that the current price of lithium carbonate has a high price and it basically executes a new order every two weeks, but cathode material companies generally have higher receivables. Therefore, it can only reduce the purchase of lithium carbonate and even start to reduce production.

Li Jigang pointed out that the price of lithium carbonate is difficult to fall in the short term and the market supply is still tight. With the outbreak of new energy vehicle market in the second half of the year, the demand for upstream materials will increase, which will further boost the price of lithium carbonate, and cathode material companies will face double attacks. .

It is worth noting that, in addition to pulling downstream demand, the upstream supply capacity reduction also provides a basis for the price of lithium carbonate.

The industry believes that the price increase of lithium carbonate is mainly caused by the imbalance between supply and demand. In general, the price rise of lithium carbonate in this wave mainly has the following factors:

1. The new energy auto market is picking up, and the downstream market has strong demand. Affected by multiple factors including adjustment of subsidy policies and reconsideration of recommended catalogues, the development of the new energy auto market in the first half of the year was less than expected. However, in the third quarter, the new energy auto market recovered in an all-round manner. Power battery shipments rose sharply, stimulating the production and sales of upstream raw materials, and the demand for lithium carbonate was strong. The imbalance in supply and demand led to rapid price increase.

2. Upstream price of lithium concentrate raw materials. Benefiting from the continuous pull of demand in the downstream market, the supply of raw materials for lithium concentrates in the upper reaches is tight, and prices have begun to rise, supporting the rise in prices of lithium carbonate.

3, the new production capacity release period is long. At present, there are few companies that can supply lithium carbonate in a stable manner in China, and the release of effective production capacity of domestic lithium salt manufacturers faces different bottlenecks, resulting in tighter supply in the market.

4. Environmental inspections have led to capacity reduction. Affected by the recent nationwide environmental inspections and rectification operations, lithium carbonate producers have started to stop production, reduce production, and rectify, resulting in a reduction in production capacity and release of new production capacity, which has aggravated the price increase of lithium carbonate.

From an objective point of view, lithium carbonate will experience price fluctuations in the coming period but will maintain high prices. The continued growth of the downstream new energy vehicle market will provide strong support for upstream material price increases.

Tianqi Lithium also stated that the price fluctuation of lithium carbonate is determined by the market supply and demand sides, but it is unlikely to return to the level before the demand for power batteries broke out. Resource cost support for prices is significant, for example, the lithium carbonate cost corresponding to the raw material price of the new production project will support the lithium carbonate price.

Industry recruits quickly join the battlefield

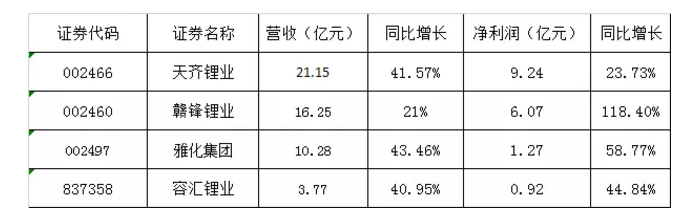

As one of the most “money†industries in the lithium battery industry, the production and sales of lithium carbonate are not only full of profits from companies such as Tianqi Lithium Co., Ltd. and Haofeng Lithium Co., Ltd., but also attract a large number of companies that are jealous. Cross-border layout.

The above-mentioned enterprises stated in the semi-annual report that the company’s substantial increase in net profit was mainly due to the strong demand for lithium batteries, and the demand for lithium carbonate materials by downstream lithium-ion materials companies remained strong, resulting in the maintenance of high prices of lithium carbonate.

At the same time, the analysis of the semi-annual report can be found that the lithium-ion resources of the upper reaches of the Tianqi Lithium, Hao Feng Lithium and other large lithium carbonate companies such as product gross margin and profitability levels, significantly higher than other companies involved in pure lithium carbonate business only listed companies This also shows that mastering the upstream mineral resources will be the key to the further development and growth of lithium carbonate companies.

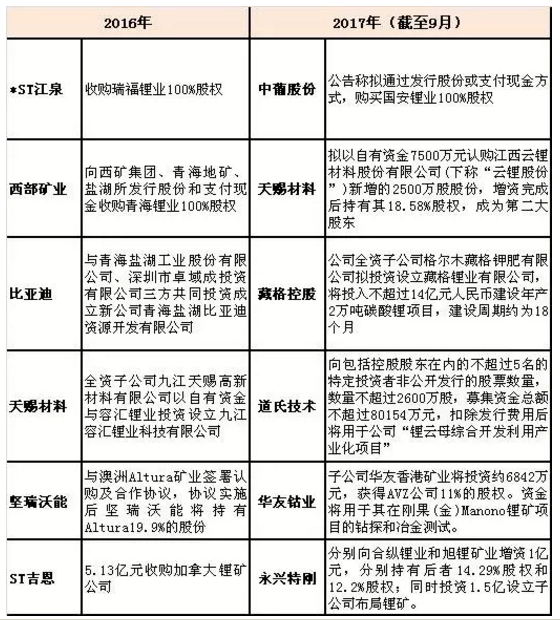

Based on the current rise in the market price of lithium carbonate and the rapid growth of the new energy automotive industry, there are also a large number of enterprises in the form of lithium carbonate business through the form of holding, equity participation, or self-building, but mainly in the lithium carbonate production and processing and sales in order to quickly enter the market The direct distribution of upstream lithium resources is relatively small.

It is worth noting that currently, the lithium carbonate market is highly concentrated. The above-mentioned enterprises choose to cross-boundary layout lithium carbonate business in this market will face the risk of new energy policy fluctuations, project development is blocked, market price fluctuations, excess production capacity and other risks, which for the company can It is an unknown number to successfully implement transformation and upgrading.

Elevator Counter Weight, Counter Weights, Elevator Counter Weight Design

Realever Enterprise Limited , https://www.cnelevator-parts.com

![<?echo $_SERVER['SERVER_NAME'];?>](/template/twentyseventeen/skin/images/header.jpg)