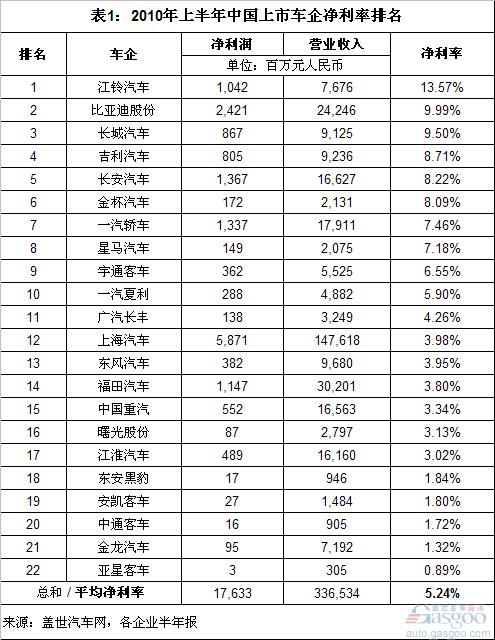

In the first half of this year, what kind of positive impact will the auto market in China have on the profits of auto companies? Judging from the statistics of 22 Chinese automobile companies listed in Shanghai, Shenzhen, and Hong Kong by Gasgoo.com, in the first half of 2010, Chinese listed car companies achieved a total operating revenue of 336.534 billion yuan, an increase of 81.93% over the same period of last year, and net profit. The total (176.33 billion yuan) grew by 191.64% year-on-year, and the average net interest rate (5.24%) was also about two percentage points higher than the same period last year (3.27%).

Jiangling Motors' highest net profit rate exceeds BYD, Geely, and Great Wall

The top five listed car dealers with the highest net profit rate in the first half of the year were Jiangling Motors (13.57%), BYD (9.99%), Great Wall Motors (9.50%), Geely Automobile (8.71%) and Changan Automobile (8.22%). The company with the highest net profit rate in the first half of last year was Geely Automobile (10.02%), followed by Jiangling Motors (9.16%), BYD (7.30%), Yutong Bus (5.42%) and Great Wall Motor (5.09%).

Among them, BYD's operating income and net profit all refer to its entire company's business, including battery and mobile phone parts business. However, its automotive business accounted for 53.58% of its operating income, which was RMB 12.9 billion, an increase of approximately 46.34% over the same period last year.

The listed car company with the highest operating income in the first half of this year is still Shanghai Auto, which is up to 147.618 billion yuan, and its net profit (5.871 billion yuan) is also the highest. However, its net interest rate is only 3.98%, which is lower than the above-mentioned car prices as well as Guangzhou Automobile Changfeng (4.26%), FAW Xiali (5.90%), FAW Car (7.46%) and so on. (See Table 1, Table 2)

FAW Xiali, the Great Wall and other net rates rose fastest

Among the listed major passenger car companies, the five companies with the largest increase in net profit rate compared with the same period of last year were FAW Xiali, Great Wall Motors, Jiangling Motors, Changan Automobile, and FAW Car respectively, with an increase of 4.72%, 4.41%, and 4.41%, respectively. 3.67%, 2.86%.

Bus companies turn losses into profits Yutong’s profitability is the strongest

From the net interest rates of these 22 listed car companies, it can be clearly seen that the net profit rate of companies that use buses as the main business is lower than that of companies that use passenger cars or trucks as their main business.

In the first half of 2009, China had four listed passenger car companies – Ankai Bus, Zhongtong Bus, Yaxing Bus, and Jinbei Automobile. In the first half of this year, all these companies turned losses into profits. Ankai Bus, Zhongtong Bus and Yaxing Bus achieved a net profit of 26,726,800 yuan, 15,588,500 yuan and 7,146,000 yuan respectively.

Jinbei Motor’s net profit for the first half of this year was RMB 172 million, and the net rate calculated based on this was 8.09%. However, the net profit of the company after deducting non-recurring gains and losses was negative 143.660 million yuan, and the asset-liability ratio was still as high as 93.54%. Therefore, although the company turned losses into profit, the profitability is not optimistic.

In this statistics, except for the Jinbei Automobile, other companies also announced net profit deductions for non-recurring gains and losses in the semi-annual report, but the gap between the net profit and the figure is small, and there is no negative and positive situation.

Jinbei Automobile is mainly engaged in light passenger vehicles in the field of passenger cars. Among medium and large-sized bus companies, the highest net profit rate in the first half of 2010 was Yutong Bus, which reached 6.55%, far ahead of Shuguang Group (3.13%), Jinlong Auto (1.32%), and the above-mentioned bus companies that just turned a profit. And other comprehensive companies with large and medium-sized bus services, Dongfeng Motor, Foton Motor, and JAC.

Truck Industry: Xingma Automobile has the highest net profit rate

Among the truck companies, the highest net interest rate for the first half of this year was Xingma Automobile, which represented 7.18%, while its net interest rate was only 2.65% in the same period of last year. The sudden rise in the net profit margin of Xingma Automobile is closely related to the acquisition of 100% equity of Anhui Hualing Automobile Co., Ltd., which has a strong profitability, at the end of last year.

Dongfeng Motor Co., Ltd. (sales mainly from light trucks) had a net interest rate of 3.95% for the first half of this year, and the net profit margins of Foton Motors, China National Heavy Duty Truck Group and JAC Automobile also all started at 3%. The net interest rate of Dongan Black Pan with small cards and micro cards as its main business is only 1.84%.

Note:

1. The auto companies have adjusted their financial data in the first half of 2009. This article shows the adjusted data.

2. Net profit in this article refers to net profit attributable to shareholders of a listed company or net profit attributable to shareholders of the parent company and net profit attributable to owners of the parent company.

Heat Resistant Conveyor Belt,Heat Conveyor Belt,Heat Resistant Rubber Belt

Heat Resistant Conveyor Belt Steel Cord Conveyor Belt Co., Ltd. , http://www.nsepconveyorbelt.com

![<?echo $_SERVER['SERVER_NAME'];?>](/template/twentyseventeen/skin/images/header.jpg)